voa标准英语2008-Mortgage Finance Officials Defend Actions on Ris

搜索关注在线英语听力室公众号:tingroom,领取免费英语资料大礼包。

(单词翻译)

U.S. lawmakers challenged former top executives of major government-backed mortgage finance companies to explain why they took on billions of dollars in risky1 loans. Questioning of the former heads of Fannie Mae and Freddie Mac came as a House of Representatives committee released documents showing that the executives ignored warnings about the dangers the investments could pose.The federal government assumed control of both companies this past September in the early days of the meltdown in the U.S. financial system driven by a collapse2 of the housing market.

Known as Government Sponsored Enterprises, they are public-government hybrids3 and together own or guarantee half of the more than $11 trillion in outstanding mortgage-based debt in the United States.

|

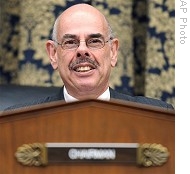

| House Oversight4 and Government Reform Committee Chairman Henry Waxman, 09 Dec 2008 |

House Oversight and Government Reform Committee Chairman Henry Waxman, a Democrat5 from California called decisions by the former executives, in some cases made despite internal warnings, irresponsible.

"Their own risk managers raised warning after warning about the dangers of investing heavily in the sub prime and alternative mortgage market," said Henry Waxman. "But these warnings were ignored"

The former officials defended actions they took as the companies ventured deeper and deeper in the sub-prime mortgage market, saying they did so to remain competitive in the larger lending market.

Richard Syron headed Freddie Mac:

"If it had not done so it could not have remained competitive or even relevant in the residential6 mortgage market we were designed to serve," said Richard Syron.

Franklin Raines, former head of Fannie Mae, asserted that federal regulators encouraged the companies to expand risker loans, while failing to exert enough oversight.

"It is remarkable7 that during the period that Fannie Mae substantially increased its exposure to credit risk its regulator made no visible effort to enforce any limits," said Franklin Raines.

But while Republicans and Democrats8 differ on the root causes of the problems at Fannie Mae and Freddie Mac, there was bipartisan impatience9 with these and other explanations.

Republican Daryl Issa said the four men were, in his words, in complete denial of any responsibility.

"Your whole excuse for going to risky and unreasonable10 loans that are defaulting at an incredibly high rate is that everyone is doing it," said Daryl Issa. "If we don't do it, we'll be left out."

Representative Dennis Kucinich, a Democrat, pressed former Fannie Mae executive Daniel Mudd on why he didn't follow the advice of the company's risk officer:

KUCINICH: "Do you take responsibility for the risks that your company took when you ignored the advice of your credit risk officer and when you cut the budget, do you take that responsibility?"

MUDD: "I followed the process to listen to all of my staff, not just the chief risk officer."

KUCINICH: "But what did you do though. What did you do. Did you cut the budget of your credit risk officer?"

MUDD: "Just liked all budgets, as long as I have been involved in business we negotiated the right number for the people that he could hire."

KUCINICH: "Is the answer yes or no, did you cut your credit risk officer's budget?"

Edward Pinto, Chief Credit Officer for Fannie Mae from 1987 to 1989 said the companies played more than a minor11 role in the sub-prime lending crisis and collapse of the housing market.

"They loosened credit standards for mortgages, which encouraged and extended the housing bubble," said Edward Pinto. "They trapped millions of people into loans they knew were unsustainable. And they destroyed the equity12 savings13 of tens of millions of homeowners spread through every congressional district in the United States."

Charles Calomiris, Professor of Financial Institutions at Columbia University Business School, says while the companies goal of promoting affordable14 housing was a motivating factor, executives took actions they knew were dangerous.

"They were experienced in this area, they knew the dangers of no docs lending [loans without sufficient proof of ability to pay] and they did it anyway," said Charles Calomiris.

Calomiris adds that both companies also acted in line with what he calls the political deal with the federal government that was well-understood in the marketplace.

Had they not relaxed their standards, which had a ripple15 effect through the market tripling risky lending, he says the sub-prime crisis might been half as severe as it has been.